FREQUENTLY ASKED QUESTIONS

EXTERNAL COMPANY

What is a foreign company?

A foreign company is required to register as an “external company” with CIPC if it conducts or intends to conduct business in South Africa. Section 23 of the Companies Act, 2008, lists a series of activities which will be regarded as conducting business.

This list includes the following:

• Holding a meeting or meetings of shareholders or board of the foreign company, or otherwise conducting the internal affairs of the company;

• Establishing or maintaining any bank or other financial account;

• Establishing or maintaining offices or agencies for the transfer, exchange or registration of the foreign company’s own securities;

• Creating or acquiring any debts, mortgages, or security interests in any property;

• Acquiring any interest in intellectual property; and

• Entering into contracts of employment.

Do I need to register an external company with the CIPC?

Yes, you must register with the Companies and Intellectual Property Commission (CIPC) within 20 business days of starting activities in South Africa.

On what platform is the service available?

The service is only available on the CIPC e-Services platform. No manual or e-mail applications are accepted.

What documents are required for registration?

• Mandate authorising the filer to file the application on behalf of the foreign company

• Resolution from the directors to register as an external company in South Africa

• Certified Certificate of Incorporation

• Certified copy of the governance or constitution

• Certified translation certificate (if documents are in a foreign language)

• Securities Register

Once my submission is rejected, can I only submit the outstanding information?

Yes, you will only be able to resubmit under a particular reference number twice before the application is finally rejected.

How must I pay for the external company registration?

You will only be allowed to pay for the submission of the external company registration after the application has been submitted and approved by the back office. You will get an automatic communication to commence payment with a link to online card payment.

Only card payments will be accepted.

What are the fees for registering an external company?

The registration fee is R400.

Do I need to do a name reservation before submitting the external company registration?

No, it is not necessary. The Name will be automatically created by the system.

Can I change the registration information after submission?

Yes, you can make changes to the registration information, but you’ll need to submit an amendment form and pay the applicable fee.

What happens if I don't register my external company?

Operating an unregistered external company is illegal and can result in penalties and fines.

Where can I find more information?

You can visit the CIPC website for detailed guidance and the latest updates on external company registration.

Who to contact when experiencing technical problems/system error?

Companies and Close Corporations: click here for more information.

Alternatively, contact the CIPC call centre, 086 100 2472.

RE-INSTATEMENTS

What is Reinstatement?

Reinstatement is the process of restoring a deregistered company or close corporation (CC) to active status or restoring its legal personality.

When is the company or CC eligible or Reinstatement?

The company or CC must have been active or held economic value at the time of deregistration. Evidence must be retained and may be requested at any time by the CIPC after the reinstatement application has been processed.

When Should You Apply?

An application for reinstatement can only be applied if the company or close corporation has finally been deregistered.

• Final Deregistration Status: Your entity will be marked as “AR Final Deregistered” or “Deregistered.”

• Not in Process: If deregistration is still in progress, file all pending Annual Returns and Beneficial Ownership declarations first.

• Inactive at Deregistration: If the company or close corporation was not operational or had no economic value at the time of final deregistration, you must register a new company. This can be done via BizPortal at a cost of R175.00.

Platforms for Automated Reinstatement

The automated reinstatement process is available on:-

• BizPortal

• e-Services

• CIPC Self-Service Terminals (SST)

Any documents required?

Reinstatement of a company and close corporation is a fully automated process, and therefore, no upload of documents will be required except if the application is a court order.

How Do I Submit a Reinstatement Court Order?

Use e-Services, and select Court order under the application type, indicate the court order detail and upload the court order. The court order will be verified by the CIPC back office.

No fee is charged for court order-based reinstatement (R0.00).

CIPC only processes a court order once and therefore ensures that the court order instructs the company or close corporation to comply with its outstanding administrative obligations e.g., Annual Returns, the latest Beneficial Ownership Declaration, and AFS/FAS. Failure to file such administrative requirements by the company concerned will result in the company or close corporation being placed back into AR Deregistration.

Will the Company or Close Corporation Keep Its Original Name?

Yes. Upon successful reinstatement, the company or close corporation will retain its original registered name since it is reinstated as if it was never been deregistered. It should be noted that, during the final deregistration period, another company or close corporation may have applied for a similar or identical name. In such an instance, you will have to approach the Companies Tribunal for a decision as to who is the strongest right to the name, and to require the other party to change its name.

How do I pay?

The company or close corporation will be required to pay using CIPC card payment facility – no declining balance or deposits allowed.

Ensure that your bank card is authorised for electronic payments.

Once the reinstatement application has been submitted, an email notification will be received to indicate that the application must be paid for. Once received, log back in and go to Cart to finalise the application. Customers have 5 working days from submission of the application to pay for the application. If not paid for within 5 working days, the application will be deleted, and a new application must be submitted.

Confirmation & Status Updates

The status of the company or close corporation will only change once the reinstatement application was paid for or the court order has been confirmed by the back office. At such time, an email will be received to indicate that application or court order has bee processed and the next steps.

If a reinstatement application, the status will change to “reinstatement process” whereafter all outstanding Annual Returns, latest Beneficial Ownership Declarations and AFS/FAS must be submitted within 30 business days to complete the process. If not submitted, the status will revert back to final deregistered, and a new application must be submitted. Once all the filings occurred, the status will change to “in Business.”

Important Notes

• 30 Business Days Rule: If annual returns are not filed within 30 business days after reinstatement, the entity will be deregistered again.

• False Information: Submitting false data is a criminal offense and may result in revocation of the reinstatement.

What is the new registration process?

The new registration process allows you to register without uploading documents or obtaining signatures from all directors. Instead, an OTP will be sent to each director/founding member for verification.

How does the OTP verification work?

Each director will receive an OTP on their registered mobile number and OTP via email with links. They need to enter this OTP via the link to verify their identity.

What information do I need to provide during registration?

You will need to provide basic information about your co-operative and its directors, including names, contact details and identification numbers.

How long does the registration process take?

The registration process is quick and efficient. Once all directors have verified their identities using the OTP, the actual registration takes few minutes.

What if a director does not receive the OTP?

If a director does not receive the OTP, they can request a resend option on the registration portal. Ensure that the contact details provided are correct and up to date.

Can I still upload documents if I want to?

No, the new process does not support document uploads. All necessary verifications will be done through the OTP system.

Is the OTP system secure?

Yes, the OTP system is secure and ensures that only authorised directors can verify and complete the registration process.

What should I do if I encounter issues during registration?

If you encounter any issues, you can contact our support team via email (coopregenq@cipc.co.za).

Can I make changes to the registration information after submission?

Yes, you can make changes to the registration information before the final submission. Once submitted, you may need to contact support for any further amendments.

Will I receive a confirmation after registration?

Yes, once the registration is complete, the person who registered the new cooperative will receive a confirmation email with all the details of your registration including the registration certificate.

What is an annual return?

An annual return is a mandatory fee that cooperatives must pay with the Companies and Intellectual Property Commission (CIPC) to confirm that the cooperative is still in business and that its information is up to date.

Why is it important to file annual returns?

Filing annual returns is crucial because it ensures that the cooperative remains in good standing with the CIPC. Failure to file can result in penalties and the eventual deregistration of the cooperative.

How do I file an annual return?

You can file your annual return online https://k2.cipc.co.za/Customers/Runtime/Form/CIPC.Customer.Form.CustomerRegistrationLandingPage

You will need to log in, complete the required information, and pay the applicable fee.

What are the fees for filing annual returns?

The fees for filing annual returns vary based on the turnover of the cooperative. You can find the fee structure on the CIPC website.

|

Type of Co operative |

Primary |

Secondary |

Tertiary |

|||

|

Turnover |

Less than 1 Mil |

1 Mil less than 10 Mil |

10 Mil less 25 Mil |

25 Mil or more |

||

|

Fees Payable |

R 50.00 |

R 50.00 |

R 450.00 |

R 3 000.00 |

R 3 000.00 |

R 3 000.00 |

What happens if I do not file the annual return on time?

If you do not file the annual return on time, the cooperative may incur penalties, and if the return is not filed for an extended period, the cooperative may be deregistered.

Can I file an annual return if my co-operative is dormant?

Yes, even if your cooperative is dormant, you are still required to file an annual return to keep the cooperative in good standing.

How can I check the status of my annual return filing?

You can check the status of your annual return filing through the CIPC e-services portal by logging into your account.

Who needs to submit annual information?

All registered cooperatives are required to submit annual information to the Companies and Intellectual Property Commission (CIPC) to ensure compliance with the Act.

What information needs to be submitted annually?

|

Mandatory Reports to be attached |

PRIMARY |

Secondary |

Tertiary |

|||

|

Less than 1 Mil |

1 Mil less than 10 Mil |

10 Mil less 25 Mil |

25 Mil or more |

|||

|

CO-OP7 Form |

X |

X |

X |

X |

X |

X |

|

Management Decision report |

X |

X |

||||

|

Social report |

X |

X |

||||

|

Statistical Information to be captured via the application (CO-OP8) |

X |

X |

X |

X |

X |

X |

|

FORM-CO-OP-15.1 |

X |

|||||

|

FORM-CO-OP-15.2 |

X |

|||||

|

Auditors Report |

X |

X |

X |

|||

|

Independent Review |

X |

|||||

|

Financial Statement- AFS |

X |

X |

X |

|||

|

XBRL (Upload Annual Financial Statement-AFS) |

X |

X |

X |

X |

X |

X |

When is the deadline for the annual submission and annual returns ?

The annual submission of information must made within 15 days after the AGM was held.

How do CO Operatives determine their date of filing during this roll out phase?

All Co-operative with their annual anniversary date from 1 November 2024 onwards must file within the legislative timeframe in other words 15 days after the AGM was held.

How do I submit the annual information?

The information can be submitted online through the CIPC’s e-services portal. You will need to log in with your cooperative’s credentials and follow the instructions provided.

What happens if a co-operative fails to submit the required information?

Failure to submit the required information can result in penalties, deregistration of the cooperative, and other legal consequences.

What information needs to be submitted annually

|

Mandatory Reports to be attached |

PRIMARY |

Secondary |

Tertiary |

|||

|

Less than 1 Mil |

1 Mil less than 10 Mil |

10 Mil less 25 Mil |

25 Mil or more |

|||

|

CO-OP7 Form |

X |

X |

X |

X |

X |

X |

|

Management Decision report |

X |

X |

||||

|

Social report |

X |

X |

||||

|

Statistical Information to be captured via the application(CO-OP8) |

X |

X |

X |

X |

X |

X |

|

FORM-CO-OP-15.1 |

X |

|||||

|

FORM-CO-OP-15.2 |

X |

|||||

|

Auditors Report |

X |

X |

X |

|||

|

Independent Review |

X |

|||||

|

Financial Statement- AFS |

X |

X |

X |

|||

|

XBRL (Upload Annual Financial Statement-AFS) |

X |

X |

X |

X |

X |

X |

Can I get assistance with the submission process?

Yes, the CIPC provides resources and support for cooperatives. You can contact our helpdesk or visit their website for guidance. Furthermore, there is a dedicated email address for Annual Returns Queries relating to CO-operatives

What are the common mistakes to avoid during the submission?

Common mistakes include:

- Missing the submission deadline

- Incomplete or inaccurate financial statements

- Not updating changes in directors or members

- Failing to pay the required fees

- Not submitting the mandatory reports

Where can I find more information about the Co-operatives Act 14 of 2005?

You can find more information on the CIPC website or consult the full text of the Cooperatives Act 14 of 2005 available online

What is B-BBEE?

B-BBEE stands for Broad-based Black Economic Empowerment. It’s a legislative framework in South Africa aimed at promoting the economic participation of black individuals in the economy. This framework was established through the Broad-based Black Economic Empowerment Act 53 of 2003.

What does the Broad-based Black Economic Empowerment Act 53 of 2003 intend to achieve?

The Act intends to:

- Establish a legislative framework for promoting black economic empowerment.

- Empower the Minister to issue codes of good practice and publish transformation charters.

- Establish the Black Economic Empowerment Advisory Council.

- Address matters connected with these goals.

For more information on the intentions or objectives of B-BBEE, you can visit the B-BBEE Commission website, which falls under the Department of Trade & Industry and Competition.

Who is responsible for B-BBEE?

The B-BBEE Commission is responsible for the administration of the Broad-based Black Economic Empowerment (B-BBEE) legislation.

What role does CIPC play in B-BBEE?

CIPC supports the B-BEE Commission by providing the Micro Exempted Affidavit in an electronic format on its platforms. While CIPC plays a supportive role, it is not the administrator of B-BBEE legislation or its related services.

Where can I find the definitions related to B-BBEE?

Refer to the Broad-Based Black Economic Empowerment Act 53 of 2003 for definitions and detailed information regarding B-BBEE.

What are the requirements for applying for a B-BBEE Certificate?

To apply for a B-BBEE Certificate, the following requirements must be met:

- Beneficial Ownership Declaration and Annual Return Filings: Ensure the relevant company or close corporation has updated filings.

- Enterprise Status: The enterprise should have a status of “In Business” to proceed with the application.

- Application Timing: The B-BBEE Certificate can be applied for during company registration, Annual Return renewals, or independently.

- Application Frequency: A company or close corporation can only apply once within a 12-month period.

- Active Directorship/Membership: If you are not an active director or member, necessary amendments should be completed before applying.

What business types may apply via the CIPC platforms for a B-BBEE Certificate?

Companies, Close Corporations, and Co-operatives are eligible to apply for a B-BBEE Certificate through the CIPC platforms.

What if my company has an outstanding Beneficial Ownership Declaration and Annual Returns?

Before applying for a B-BBEE Certificate, it’s crucial to ensure that your Beneficial Ownership (BO) Declaration and Annual Returns are up to date.

Where can I apply for a B-BBEE Certificate?

You can apply for a B-BBEE Certificate through the following channels:

- E-services

- Bizportal

- CIPC self-service terminals

Click here for step by step guide.

What if I do not have a customer code, can I still transact with CIPC?

Yes. You can still transact with CIPC through Bizportal, which uses ID numbers instead of a customer code.

Is it true that CIPC no longer verifies directors against relatives when applying?

Yes, it is true. CIPC no longer verify directors or members against their relatives.

How much does it cost to apply for a B-BBEE Certificate?

Applying for a B-BBEE Certificate at CIPC is a value-added service and is offered free of charge.

Can a foreign director apply for a B-BBEE Certificate at CIPC?

No, foreign directors do not qualify to apply for a B-BBEE Certificate at CIPC.

How many shareholders must I capture when applying for a B-BBEE Certificate?

There is no set limit on the number of shareholders you must capture. All black shareholders should be included when applying for a B-BBEE Certificate.

Will I be able to save the information that I already captured during the B-BBEE application process and finalise it later?

Yes, you can save and continue with the application later. Note that the draft is available for only 30 days, and thereafter, you will have to start from the beginning.

Is it mandatory to include sector charter council and SIC code when applying for B-BBEE Certificate as part of data capturing?

Yes, it is mandatory to capture sector charter council and SIC code when applying for B-BBEE Certificate.

Will the chosen charter and SIC reflect on B-BBEE Certificate?

Yes, the chosen charter and SIC code will be reflected on the B-BBEE Certificate.

How do I decide that the SIC code is for my business?

CIPC uses the SIC codes as published by SARS. The SIC code can be confirmed by visiting the SARS site and conducting a search.

Standard Industrial Classification Codes | South African Revenue Service

Will all directors and black shareholders receive OTP and SMS?

No, OTP and SMS will be sent only to the filer. However, all directors and shareholders whose information was captured during the service will be notified via e-mail.

How long is the OTP valid?

The OTP is valid for 96 hours. After this period, you will need to request a new OTP.

Can the shareholders share the same e-mail address?

No, each shareholder must have their own email address. This requirement ensures that each shareholder receives a personal notification regarding their inclusion in the BBBEE Certificate application process. As it involves their personal information, it is essential for each shareholder to be individually informed.

What does it mean that the director or member must be verified first before completing the B-BBEE application?

This means that before the B-BBEE Certificate application can proceed, the CIPC needs to confirm the identity of the directors or members involved. This step ensures that the application is legitimate and that the individuals applying are authorised and verified.

How many times may I apply for a B-BBEE Certificate?

You may apply for a new B-BBEE Certificate each year. The B-BBEE Certificate is valid for a 12-month period. Once your current Certificate has expired, you can then apply for a new one to maintain your certification.

What if the information changed before one year lapses, can I update the Certificate?

The initial B-BBEE information cannot be changed during the 12-month validity period of the B-BBEE Certificate. However, if there are significant changes, you can address them by downloading the B-BBEE Affidavit. Complete and commission the affidavit, then attach it alongside your tender documentation. You can find the download link for the affidavit below.

Does CIPC B-BBEE Certificate carry the same weight as B-BBEE Sworn Affidavit?

Yes.

Who is eligible to apply for a B-BBEE Certificate through CIPC?

Only active directors of companies, active members of close corporations, and cooperatives are eligible to apply for a B-BBEE Certificate through CIPC platforms.

Can intermediaries or third parties apply for a B-BBEE Certificate on behalf of someone else?

No, intermediaries or third parties are not permitted to apply on behalf of their clients. Only the active directors or members themselves can apply.

What information needs to be accurate during the application process?

The shareholders’ information must be accurate and up to date. Providing incorrect information is a criminal offence and can lead to legal action.

What is the different B-BBEE levels found on B-BBEE Certificates issued by CIPC?

• B-BBEE LEVEL 1 CONTRIBUTOR: 135% PROCUREMENT RECOGNITION

Or 100% black shareholders

• B-BBEE LEVEL 2 CONTRIBUTOR: 125% PROCUREMENT RECOGNITION

Or 51% to 99% black shareholders

• B-BBEE LEVEL 4 CONTRIBUTOR: 100% PROCUREMENT RECOGNITION

Or 0% to 50% black shareholders

NB: CIPC is not authorised by the dtic to issue a B-BBEE Level 3 Contributor.

How can I update the contact details for a director or member to receive an OTP?

To update the contact details for a director or member, visit https://eservices.cipc.co.za and select the “Update director/Member contact” option. This will allow you to ensure that the information is current.

Will I receive the OTP if director or member details are not yet updated?

No, you will not receive the OTP unless the details, such as the email address and cell phone number, are updated on the CIPC database. It is crucial to ensure that all information is current to facilitate receiving OTPs and other communications.

Who should I contact for inquiries?

For any inquiries related to Co-operatives, please email your questions to: coopregenq@cipc.co.za

For any inquiries related to Companies and Close Corporations, you can send an email to: enqbeedomain@cipc.co.za.

Alternatively, contact the CIPC call centre, 086 100 2472.

Can I reserve a name on New E-service and use it on any other CIPC platform?

- No, names approved via New E-services platform cannot be used on any other platform e.g Mobile App, BizPortal or e-Services at the moment.

Can I download the name reservation confirmation?

- Yes, you can download the name reservation confirmation. The confirmation is free of charge for the first 30 calendar days for the customer who reserved the name reservation, whereafter it carries a R30.00 fee as per Item 9 (Issuing of electronic certificate) of Table CR2B of the Companies Regulations, 2011 (as amended).

Can I apply for a defensive name on the New E-service?

- Defensive name registration will be released at a later communicated date on New E-Services.Defensive name registration requires proof of material interest in such a name and still must be filed manually to e-mail (namereservationsandregistrations@cipc.co.za).

Can I apply for a name that is part of my group of companies or Association?

- Such will be released at a later communicated date on New E-Services.

- Application for a name with associations and or part of your already registered must still be filed via e-mail (namereservationsandregistrations@cipc.co.za) together with proof of association as well as certified ID copy of directors or members of the said associated entity.

In case my name is rejected, how and where can I go for the review?

- Any review relating to a name reservation should be directed to the Companies Tribunal. For contact information refer to www.companiestribunal.org.za

What are the payment methods?

- Card payments can be used at this stage. More electronic payment methods will be implemented at a later stage e.g. EFT.

When to pay for name reservation?

- Name reservations MUST be paid for by midnight of the day the application is submitted, failure of which the transaction will be deleted.

Who to contact when experiencing technical problems/system error?

- A ticket must be logged via the CIPC online enquiry system www.cipc.co.za/enquiries. Select the correct Department.

- Alternatively, contact the CIPC call centre, 086 100 2472.

What is New e-Services Company Registration?

-

Is Workflow Business Process Automation tool

- Enable Customer to register a Company without submission of documents (fully automated) only if appointed directors are South African.

- Pay Company Registration fee using card payment

- Improve Turnaround time(same time registration)

Where and how can I access New e-Services for New Company registration portal?

-

Customer Registration Entrance Page

- Access web address to be updated closer to the time.

Customer Portal

- Access web address to be updated closer to the time.

New e-Services for New company registration process

- Customer login

- Creates a company application

- The system approves immediately ( only if directors are South African) or sends the application to back-office for approval ( only if passport attached for foreign nationals directors)

- Finalise payment

- Registration certificate email

- The transaction can be queried by CIPC users.

Step by step process

-

- Customer login

- Capture Customer information

- Capture company Type

- Click Company Registration Tab (Select name reservation number / apply for a name/ continue without a name) (NB. If customer started name reservation on e-services, they will have to use the e-services new company registration function to complete the registration. If used new e-services for name reservation then they must use new e-services platform to register a new company).

- Capture Financial Year End

- Capture Enterprise and Customer email address

- Capture Business and Postal address

- Capture director’s details (ID, Name, surname, cell phone, residential and postal address (NB. The company e-mail address and director’s cell phone numbers will be required to be validated via return e-mail or cell phone confirmation).

- Capture auditors details ( Name and Practice Number)

- Capture payments information ( card number and payment amount)

- Finalise payment

- Submit transaction

Please find a step by step guide hereEnd

Do I have to submit company documents?

- No, it is a fully automated system.

When do I submit company documents?

- Company documents are ONLY submitted when there is a foreign director appointed and a passport is attached for back-office processing.

Does New e-Services system accept passport as proof of identity?

- Yes, CIPC does not accept passports or driver’s licenses for South African citizens as proof of identity. Passports are only accepted for foreign nationals.

What does it mean that the director or member must be verified first before completing the New e-Services for New Company Registration application?

- CIPC needs to confirm the identity of the directors/members who are applying using New e-Services Company Registration and confirming such information in real-time with the Department of Home Affairs.

Can I register Short standard Non Profit Company via New e-Services system?

- The New e-Services company registration to go live is short standard private company only.

- CoR15.1C to go live at a later date.

What are the payment methods?

- Card payments can be used at this stage, more electronic payment methods will be implemented at a later stage e.g. electronic EFT.

How long do I have to make payment?

- The registration will only be finalised and the necessary registration information issued, if the payment was successful.

- You have 5 calendar days to make a payment, failure of which the transaction will be deleted and you will have to restart the process.

Can I download the registration documents (registration certificate, Memorandum of Incorporation, Welcoming Letter, and Confirmation Certificate) and how much does it cost?

- Yes, you can download the new company registration information. The registration information is available free of charge for the first 30 calendar days for the customer who submitted the new company registration documents and the appointed directors, whereafter it carries an R30.00 fee as per Item 9 (Issuing of electronic certificate) of Table CR2B of the Companies Regulations, 2011 (as amended).

- Any other person who wants to download the new company registration information can also download the new company registration information at a cost of R30.00.

Can I still apply for company registration via other channels?

-

Yes. Can register as a customer through any of the CIPC channels:

- SST (Self Service Terminal);

- Banks

- Bizportal

Who to contact when experiencing technical problems/system error?

- A ticket must be logged via the CIPC online enquiry system www.cipc.co. za/enquiries. Select the Department as Companies and Close Corporations /Company Registrations.

- Alternatively, contact the CIPC call centre, 086 100 2472.

What is annual returns?

All companies (including external companies) and close corporations are required by law to file their annual returns within a certain period of time every year. CIPC will remind companies and close corporations annually to file their annual returns provided that CIPC has the correct electronic contact information of directors and members.

An annual return is a statutory return in terms of the Companies and Close Corporations Acts. Failure to file annual returns results in the CIPC assuming that the company and/or close corporation is not doing business or is not intending doing business in the near future. Non-compliance with annual returns, beneficial ownership declaration and AFS/FAS will lead to deregistration, which has the effect that the juristic personality is withdrawn, and the company or close corporation ceases to exist. Active directors of companies and active members of close corporations may still be held liable for actions taken during their tenure and while the company or close corporation was in business.

When filing the annual return, the company or close corporation MUST also file its latest Beneficial Ownership declaration as well as its Audited Financial Statements (AFS) or Financial Accountability Supplement (FAS).

- Companies have 30 business days from the date when annual returns become due to file annual returns before they are considered non-compliant with the Companies Act. Late filing will result in penalties being incurred.

- Close corporations have, from the first day of its anniversary month up until thereafter, to file annual returns before they are considered non-compliant with the Close Corporations Act. Late filing will result in penalties being incurred.

- Annual returns can only be filed electronically by clicking here. Alternatively, it can be filed via e-Services.

Will my personal detail as a director or member be disclosed on the annual return?

Due to security concerns relating to the disclosure of personal information CIPC has affected the following changes relating to annual returns:

- Only the first 6 digits of a director’s or member’s identification number will be displayed; and

- The annual return filing certificate will not display the identity number, personal address, or contact details of a director or member.

Can annual returns be filed manually?

No. Annual returns can only be filed electronically via any of the CIPC electronic platforms:

- BizPortal

- E-Services

- Self Service Centre

How do I file annual returns?

Annual returns can only be filed electronically via any of the CIPC electronic platforms:

- BizPortal

- E-Services

- Self Service Centre

What will happen if the company or close corporation does not comply with annual returns?

The CIPC will assume that the company or close corporation is inactive, and as such CIPC will start the deregistration process to remove the company or close corporation from its active records. The legal effect of deregistration is that the juristic personality is withdrawn, and the company or close corporation ceases to exist.

Other organisations e.g. banks, Central Supplier Database, service providers may refuse service since the company or close corporation no longer exists. Directors and members active at the time of deregistration may be held liable for all debts.

Must Beneficial Ownership Declaration be filed with the annual return?

Yes. Before being able to file the annual return, the company or close corporation must first ensure that CIPC has its latest Beneficial Ownership Declaration. If not, click on the link to file the Beneficial Ownership Declaration. Once filed, you need to proceed to continue with the annual return filing process.

Who may file an annual return on behalf of a company or close corporation?

Due to the nature and the content required on an annual return, such must be filed by the company or close corporation or its duly authorised representative that is in a position to provide the required information.

When annual returns is filed, the company or close corporation will also be required to submit the latest Beneficial Ownership Declaration and AFS/FAS. For more information on Beneficial Ownership and AFS/FAS refer to the relevant sections of this FAQ.

When must a company or close corporation file its annual returns?

It is an annual filing and it differs for companies and close corporations. Companies must file (regardless as to whether it was active or not) within 30 business days starting from the day after its date of registration. Close corporations must file (again regardless as to whether it was active or not) starting from the first day of the month it was registered up until the month thereafter. It may still file after such period, but an additional penalty fee will be applicable.

If a company or close corporation has filed its tax returns with SARS, is it still required to file annual returns with CIPC?

A clear distinction must be made between an annual return and a tax return. An annual return is a summary of the most relevant information regarding the company or close corporation and is filed with CIPC while a tax return focuses on taxable income of a company or close corporation in order to determine its tax liability to the State and is filed with SARS.

Compliance with the one does not mean that there is compliance with the other. It is two different processes, administered in terms of different legislation by two different government departments.

How do I change the name of my company if it was initially registered with only a registration number?

Practice note 1 of 2014

The Companies Act, 2008 provided that a company can be registered with the company number as its name. This is the quickest way to secure a company registration in order to start doing business.

The process of doing the consequent name change was found by the public to be cumbersome and requires additional costs, and the CIPC strive to assist in always streamlining processes.

Therefore, the CIPC has approved a separate name change process to be followed in instances where the company registration was done without a name reservation and was awarded a registration number as the name of the company. In such instances, the company in question still need to apply for a relevant name reservation and lodge the necessary name change application documentation with the CIPC, but the name change process will be free of charge.

The requirements for the waived fee to be applicable are as follows:

- Company must have been incorporated with its registration number as its name;

- Only companies amending its name for the first time after being incorporated with its registration number as a name;

- Applicable from 3 March 2014

Companies meeting the above criteria will be allowed the waiver of the R250 amendment fee and must ensure that the correct documents are lodged via the dedicated e-mail address for this purpose, namely namechange@cipc.co.za.

Important to note is that only the amendment fee is waived, and it is still the responsibility of the relevant company to see to the name reservation following the normal process protocols, prior to lodgment of the name change application.

Required documentation:

- COR15.2 (completed and signed by active director/company secretary)

- Copy of the resolution confirming the approval of the name change

- Copy of the approved name reservation – COR9.4

- Copy of the certified ID of the COR form signatory

- Approved names which include the word “sure” (e.g telesure, insurance, etc) must lodge an approval by the Financial Services Board (FSB) to use the name

- Ensure the customer code is clearly visible on the COR form for tracking purposes

How do I view my account statement/the balance in my customer account?

Follow these steps to view your account statement online:

- Visit the CIPC website – www.cipc.co.za

- Log in using your customer code and password

- Click on “Additional services”

- Click on the second link on the left menu, i.e. “Customers Transactions”

- Select the relevant icon to download your statement

How do I update my customer contact details?

CIPC is committed to customer service, and to communicate important information and developments to our customers.

1. Updating customer contact details

To enable CIPC to reach customers, all customers are requested to update their customer profile (customer code details) with CIPC. Updated e-mail address and cell phone numbers are of special importance for communication purposes.

Steps to view and edit your customer profile:

- Log in as CIPC customer on the Home page by clicking on Customer login.

- In the top left corner of the screen, click on your customer name displayed. This will display the customer profile information.

- Review all information and update.

2. Updating company details

Updating of company contact details is very important from a compliance perspective. Enterprises should ensure that CIPC are always kept up to date with the latest company information. To view information on how to update private company details, click here.

How do I retrieve a certificate?

Customers are able to confirm the status of applications and reprint confirmation letters and certificates for processed companies and close corporation application from the CIPC website. These functions are accessible on the CIPC website as follows:

Document status

- Visit the CIPC website www.cipc.co.za

- Sign in with your customer code and password

- Click on “On-line transacting”

- Click on “Additional services”

- On the left menu, click on “Customers”, and then on “Document Status”

Confirmation letter

Visit the CIPC website www.cipc.co.za

- Sign in with your customer code and password

- Click on “On-line transacting”

- Click on “Additional services”

- On the left menu, click on “Customers”, and then on “Customer Confirmation Letter”

Note 1: You will only be able to use this function if the application was submitted under your customer code.

Note 2: If the confirmation letter did not go through Dispatch, it will not reflect on the confirmation letter function.

To obtain a copy of documents or certified copies, click here to request it.

What are the duties of Accounting Officer in relation to report that liabilities of CC is exceeding assets

Duties of accounting officers

62.(1) The accounting officer of a corporation shall, not later than three months after completion of the annual financial statements-

(a) subject to the provisions of section 58 (2) (d), determine whether the annual financial statements are in agreement with the accounting records of the corporation;

[Para. (a) substituted by s. 13 (1) (a) of Act 38 of 1986.]30

(b) revi ew the appropriateness of the accounting policies represented to the accounting officer as having been applied in the preparation of the annual financial statements; and

[Para. (b) substituted by s. 13 (1) (a) of Act 38 of 1986 and by s. 4 (a) of Act 17 of

1990.]

(c) report in respect of paragraphs (a) and (b) to the corporation.

(2) (a) If during the performance of his duties an accounting officer becomes aware of any contravention of a provision of this Act, he shall describe the nature of such contravention in his report.

(b) Where an accounting officer is a member or employee of a corporation, or is a firm of which a partner or employee is a member or employee of the corporation, his report shall state that fact.

(3) If an accounting officer of a corporation-

(a) at any time knows, or has reason to believe, that the corporation is not carrying on business or is not in operation and has no intention of resuming operations in the foreseeable future; or

(b) during the performance of his duties finds-

(i) that any change, during a relevant financial year, in respect of any particulars mentioned in the relevant founding statement has not been registered;

(ii) that the annual financial statements indicate that as at the end of the financial year concerned the corporation’s liabilities exceed its assets; or

(iii) that the annual financial statements incorrectly indicate that as at the end of the financial year concerned the assets of the corporation exceed its liabilities, or has reason to believe that such an incorrect indication is given,

[Sub-para. (iii) added by s. 13 (1) (d) of Act 38 of 1986.]

he shall forthwith by registered post report accordingly to the Registrar.

[Sub-s. (3) amended by s. 14 of Act 22 of 2001.]

(4) If an accounting officer of a corporation has in accordance with subparagraph (ii) or (iii) of paragraph (b) of subsection (3) reported to the Registrar that the annual financial statements of the corporation concerned indicate that as at the end of the financial year concerned the corporation’s liabilities exceed its assets or that the annual financial statements incorrectly indicate that as at the end of the financial year concerned the assets of the corporation exceed its liabilities, or that he has reason to believe that such an incorrect indication is given, and he finds that any subsequent financial statements of the corporation concerned indicate that the situation has changed or has been rectified and that the assets concerned then exceed the liabilities or that they no longer incorrectly indicate that the assets exceed the liabilities or that he no longer has reason to believe that such an incorrect indication is given, as the case may be, he may report to the Registrar accordingly.

Must financial statements be filed with the annual returns?

Companies (except external companies) are required to either file its audited financials, reviewed financials or financial supplement with its annual returns.

All companies (except external companies) and close corporations, if it is required in terms of Companies Regulation 28 read with Companies Regulation 26 to prepare audited financial statements, must file such with CIPC at the same time of filing is annual returns via www.cipc.co.za / e-services / logon using customer code and password / transact / document upload / annual financial statements.

Companies and close corporations that is neither required to file its audited financial statements nor voluntarily filed its audited financial statements or reviewed financial statements, must file a financial accountability supplement (CoR30.2) after filing its annual returns by completing the online form via the CIPC website www.cipc.co.za / Maintain Your Business / Financial Statements and Independent Review

Which set of financial statements should be used to determine the turnover of the company or close corporation for purposes of filing annual returns?

A company or close corporation must use its latest approved financial statements for purposes of determining the turnover for purposes of filing annual returns.

How do I determine the entity’s turnover?

Annual Turnover is referred to in table CR 2B – Commission Fee Schedule of the Companies Regulation 2011 and Schedule 1: Fees of the Close Corporation Administrative Regulations. Section 223 read with Regulation 164 of the Companies Act, clearly sets out what constitutes turnover and the method required to calculate turnover for the purpose of determining the correct annual return fee to be paid to the CIPC

When must a company file audited financial statements, reviewed financial statements or a financial supplement with its annual returns?

All companies must prepare annual financial statements (“AFS”). Public and State-Owned companies (SOC) must have audited AFS while a Private, Personal liability and Non-Profit company and close corporation is not required to have its AFS audited unless –

- in the ordinary course of its business, it holds assets in a fiduciary capacity for persons who are not related to the company, in excess of R5 million in value at any time during the year;

- it is a non-profit company and was directly or indirectly incorporated by the state, a state-owned company or foreign entity;

- it is a non-profit company and was incorporated primarily to perform a statutory or regulatory function in terms of any legislation or to carry out a public function; or

- its public interest score in that financial year, as calculated in accordance with Regulation 26 (2), is 350 or more or is at least 100 if its AFS have been internally compiled.

Any other company must have its AFS independently reviewed in accordance with ISRE 2400 unless –

- it is exempt, in terms of section 30 (2A) to have its AFS audited for that year or reviewed (every person who is a holder or has a beneficial interest in any securities issued is also a director of the company);

- it is required by its own Memorandum of Incorporation (“MoI”) to have its AFS audited; or

- it has voluntarily had its AFS audited for that year.

A company or a close corporation that is required to have its AFS audited, as indicated above, must file a copy of its latest approved audited AFS with its annual return while a company or a close corporation that is not required to have its AFS audited as indicated above, may file a copy of its audited, reviewed AFS or a financial accountability supplement (CoR 30.2) after its annual return.

Will CIPC provide notification of the pending deregistration?

Yes. During the deregistration process notifications are mailed to the company or close corporation’s registered postal address as per CIPC records, informing it of the intended deregistration and a request to either provide confirmation that it is still active or to file outstanding annual returns. At the time of notification, the company or close corporation’s legal persona is not yet removed. The notification only serves to inform the company or close corporation of the intention to deregister it, if no objection or filing of annual returns occurs.

Can deregistration be cancelled if the company or close corporation has been placed in deregistration due to annual return non compliance?

Yes. If deregistration is due to annual return non compliance, deregistration process will be cancelled if all outstanding annual returns are filed while it is still in such status.

WARNING: The outstanding annual returns must be filed before the date the company or close corporation is finally deregistered.

If a voluntary deregistration, an objection letter must be e-mailed to deregistrations@cipc.co.za. The objection letter must clearly state the reason for objecting to the deregistration and must be signed by the person who is objecting to the deregistration. Once signed, it must be scanned in either PDF or TIFF and e-mailed as a single e-mail with all attachments in PDF or TIFF to deregistrations@cipc.co.za.

WARNING: The objection letter must be submitted to the CIPC before the date the company or close corporation is finally deregistered. If the company or close corporation was finally deregistered, the company or close corporation must apply for re-instatement. No supporting documents are required to object to the deregistration.

If the company or close corporation was deregistered for non compliance with annual returns, can the company or close corporation still be re-instated (restored)?

Yes. Once a company or close corporation has been finally deregistered, the company or close corporation or any third person may apply for re-instatement upon filing of a form CoR40.5 and if required, supporting documents. Upon the processing of the re-instatement application, the status will be changed to “in re-instatement process”.

Should all annual returns be up to date before a close corporation converts to a company?

If a close corporation converts to a company and the conversion application on form CoR18.1 is received on or before the last day before the start of the anniversary month of the close corporation, then the annual return for such year does not need to be filed. The reason for this is that no obligation has yet arisen for the filing of the annual return for the current year. All other outstanding years must be brought up to date.

For future filing of annual returns, the anniversary month will then be the month within which the close corporation was converted.

Should the close corporation file its application for conversion within the month of the anniversary of its incorporation or the month thereafter then all annual returns must be brought up to date including the annual return for the current year.

Should all annual returns be up to date if the company converts from one category of company to the other?

No. The company does not have to be up to date with annual returns before converting but it should not be in “deregistration process” or “final deregistered”. If in “deregistration process” the company must first object to deregistration in writing (if not due to annual return non compliance) or file all outstanding annual returns (if due to annual return non compliance) before applying to convert.

If the company is final deregistered it must first be re-instated. Kindly refer to the Re-instatement section of the FAQ’s for the requirements to apply for re-instatement

What sections of the legislation governs annual returns?

Companies:

Filing Requirement:

- Section 33 of Companies Act

- Regulation 30 of Companies Regulations

Deregistration Requirement:

- Section 82(3) of Companies Act

- Regulation 40 of the Companies Regulations

Re-instatement Requirement:

- Section 82(4) of Companies Act

- Regulation 40 of the Companies Regulations

Filing of Financial Information:

- Section 30 of Companies Act

- Regulation 40 (2) – (4) of Companies Regulation

- Regulations 28 and 29 of Companies Regulations

Close Corporations

Filing Requirement:

- Section 15A of Close Corporations Act

- Regulation 16 of the Close Corporations Administrative Regulations

Deregistration Requirement:

- Section 82(3) of Companies Act

- Regulation 40 of the Companies Regulations

Re-instatement Requirement:

- Section 82(4) of Companies Act

- Regulation 40 of the Companies Regulations

Filing of Financial Information:

- Section 30 of Companies Act

- Item 5 of Schedule 5 of Companies Act (relating to the amendments of section 58 of Close Corporations Act)

- Regulation 40 (2) – (4) of Companies Regulation

- Regulations 28 and 29 of Companies Regulations

What is New e-Services Name Reservations?

- As part of CIPC’s continues improvement strategy, further enhancements have been made on name reservation service. Some of the enhancements include: –

• Automated name reservation approval for names consisting of only commonly used words and limited characters.

• Card payment facility.

• Better search results and improved service delivery.

Where and how can I access New E-services for Name Reservations?

- CIPC website www.cipc.co.za Click on the Online transaction New E-Services. Electronic proposed name filing non-refundable fee is R50.

- Separate registration as a customer (from e-Services) is required to access this platform.

What browser must I use for the best possible experience on New e-Services?

- Recommended browsers are Internet Explorer or Chrome.

(FireFox is not advised)

What and when do I pay on New e-Services for Name Reservations?

- Non-refundable name reservation filing fee – R50.

- Name reservation transactions MUST be paid for by midnight of the day the application was submitted, otherwise, it will be deleted and the application will have to be restarted.

Step by step process

NB: Kindly note that in order to be able to transact on this platform you should first registered as a customer on the New E-services and verify your details.

1. Visit the CIPC website www.cipc.co.za and click on On-line transacting/New e-Services.

2. Complete your Username (e-mail address and Password). Click on Login.

3. Click on Name Reservation, and then on Start a New Name Reservation.

4. Type your proposed name in the required field and click on Check Proposed Name Availability.

IMPORTANT NOTE: it is advisable to conduct a Trade Mark Search (https://iponline.cipc.co.za) and a general web search using a search engine like Google, Yahoo etc. before submitting your name reservation application.

5. IMPORTANT NOTE: Names may only contain Alphabetical and numeric characters and the following special characters: () . –

If the proposed name is NOT AVAILABLE, the message below will display, with the reason why the name is not available.

Note: The proposed name is not available.

• The proposed name contains forbidden word/s and cannot be submitted for review.

• The proposed name contains prohibited word/s and cannot be submitted for review.

• The proposed name has already been registered with an enterprise.

Click on “Clear Proposed Name” to enable you to continue.

6. If the name is available, a green flag will display with the words: Note: The Proposed Name is Available and can be added to the list of names being submitted for Name Reservation Approval. Click on “Add Proposed Name”

7. Follow the same process to add more unique names (Up to four proposed names can be added in order of priority or preference).

8. Once all names have been added, you can “Add to Cart” if you want to add more transactions. You can finalise all transactions and pay only once. Click on “Submit & Pay” if it is the only transaction that you would like to process.

9. Take note of the disclaimer: This is only a preliminary search and does not guarantee that one of the proposed names will be reserved. You will be notified via email of the final results. Click on OK to submit the name reservation request.

10. You will receive a name reservation reference number. Click on OK.

11. When clicking on “Shopping Cart”, all unpaid cart items will be listed. Select the transactions that you would like to pay, and click on “Add Item”. The relevant items will move to the bottom of the screen under “Selected Items to pay”.

Complete required payment information and click on Pay.

12. The total amount will be reflected. Click on Proceed to Payment.

Authenticate the transaction and click on Continue.

Examples FNB and Capitec

13. A message will display, confirming that the cardholder has been authenticated. Click on OK.

14. A payment confirmation message will display. Click on OK.

15. To continue, click on the relevant menu button to proceed to the following transaction.

Please find a step by step guide here

End

Can I apply for my company name and immediately start trading with the said name?

- No, you can only start to use your name once it is confirmed (CoR 9.4) and registered by CIPC.

Can I reserve a name on New E-service and use it on any other CIPC platform?

- No, names approved via New E-services platform cannot be used on any other platform e.g Mobile App, BizPortal or e-Services at the moment.

Can I download the name reservation confirmation?

- Yes, you can download the name reservation confirmation. The confirmation is free of charge for the first 30 calendar days for the customer who reserved the name reservation, whereafter it carries a R30.00 fee as per Item 9 (Issuing of electronic certificate) of Table CR2B of the Companies Regulations, 2011 (as amended).

Can I apply for a defensive name on the New E-service?

- Defensive name registration will be released at a later communicated date on New E-Services.Defensive name registration requires proof of material interest in such a name and still must be filed manually to e-mail (namereservationsandregistrations@cipc.co.za).

Can I apply for a name that is part of my group of companies or Association?

- Such will be released at a later communicated date on New E-Services.

- Application for a name with associations and or part of your already registered must still be filed via e-mail (namereservationsandregistrations@cipc.co.za) together with proof of association as well as certified ID copy of directors or members of the said associated entity.

In case my name is rejected, how and where can I go for the review?

- Any review relating to a name reservation should be directed to the Companies Tribunal. For contact information refer to www.companiestribunal.org.za

What are the payment methods?

- Card payments can be used at this stage. More electronic payment methods will be implemented at a later stage e.g. EFT.

When to pay for name reservation?

- Name reservations MUST be paid for by midnight of the day the application is submitted, failure of which the transaction will be deleted.

Who to contact when experiencing technical problems/system error?

- A ticket must be logged via the CIPC online enquiry system www.cipc.co.za/enquiries. Select the correct Department.

- Alternatively, contact the CIPC call centre, 086 100 2472.

What is New e-Services Company Registration?

-

Is Workflow Business Process Automation tool

- Enable Customer to register a Company without submission of documents (fully automated) only if appointed directors are South African.

- Pay Company Registration fee using card payment

- Improve Turnaround time(same time registration)

Where and how can I access New e-Services for New Company registration portal?

-

Customer Registration Entrance Page

- Access web address to be updated closer to the time.

Customer Portal

- Access web address to be updated closer to the time.

New e-Services for New company registration process

- Customer login

- Creates a company application

- The system approves immediately ( only if directors are South African) or sends the application to back-office for approval ( only if passport attached for foreign nationals directors)

- Finalise payment

- Registration certificate email

- The transaction can be queried by CIPC users.

Step by step process

-

- Customer login

- Capture Customer information

- Capture company Type

- Click Company Registration Tab (Select name reservation number / apply for a name/ continue without a name) (NB. If customer started name reservation on e-services, they will have to use the e-services new company registration function to complete the registration. If used new e-services for name reservation then they must use new e-services platform to register a new company).

- Capture Financial Year End

- Capture Enterprise and Customer email address

- Capture Business and Postal address

- Capture director’s details (ID, Name, surname, cell phone, residential and postal address (NB. The company e-mail address and director’s cell phone numbers will be required to be validated via return e-mail or cell phone confirmation).

- Capture auditors details ( Name and Practice Number)

- Capture payments information ( card number and payment amount)

- Finalise payment

- Submit transaction

Please find a step by step guide hereEnd

Do I have to submit company documents?

- No, it is a fully automated system.

When do I submit company documents?

- Company documents are ONLY submitted when there is a foreign director appointed and a passport is attached for back-office processing.

Does New e-Services system accept passport as proof of identity?

- Yes, CIPC does not accept passports or driver’s licenses for South African citizens as proof of identity. Passports are only accepted for foreign nationals.

What does it mean that the director or member must be verified first before completing the New e-Services for New Company Registration application?

- CIPC needs to confirm the identity of the directors/members who are applying using New e-Services Company Registration and confirming such information in real-time with the Department of Home Affairs.

Can I register Short standard Non Profit Company via New e-Services system?

- The New e-Services company registration to go live is short standard private company only.

- CoR15.1C to go live at a later date.

What are the payment methods?

- Card payments can be used at this stage, more electronic payment methods will be implemented at a later stage e.g. electronic EFT.

How long do I have to make payment?

- The registration will only be finalised and the necessary registration information issued, if the payment was successful.

- You have 5 calendar days to make a payment, failure of which the transaction will be deleted and you will have to restart the process.

Can I download the registration documents (registration certificate, Memorandum of Incorporation, Welcoming Letter, and Confirmation Certificate) and how much does it cost?

- Yes, you can download the new company registration information. The registration information is available free of charge for the first 30 calendar days for the customer who submitted the new company registration documents and the appointed directors, whereafter it carries an R30.00 fee as per Item 9 (Issuing of electronic certificate) of Table CR2B of the Companies Regulations, 2011 (as amended).

- Any other person who wants to download the new company registration information can also download the new company registration information at a cost of R30.00.

Can I still apply for company registration via other channels?

-

Yes. Can register as a customer through any of the CIPC channels:

- SST (Self Service Terminal);

- Banks

- Bizportal

Who to contact when experiencing technical problems/system error?

- A ticket must be logged via the CIPC online enquiry system www.cipc.co. za/enquiries. Select the Department as Companies and Close Corporations /Company Registrations.

- Alternatively, contact the CIPC call centre, 086 100 2472.

As the Enquiry system (QRS) is not currently available, what is the alternatives for customers when they want to log a query with CIPC?

The Enquiries system is currently not available. A notice in this regard was published on the website on 19 March 2024. Refer to the Notice CIPC Enquiries system not available. The email addresses for the different departments are listed.

Please do not send emails to multiple email addresses, just the one relevant email address, as it clogs the systems and makes the process to respond to queries slower. Also note that the enquiries@cipc.co.za mailbox is solely for customer verification enquiries, do not cc it or send other queries to this mailbox.

Also be reminded to provide complete details when submitting an enquiry, like your customer code, enterprise number, tracking number and detail description of the issue experienced.

An Enquiry system will be rolled out later in the year.

What is a CIPC Customer code?

It is a six-digit unique code allocated to a customer when they register as a customer on the CIPC website. This customer code is very important, as it is the unique identifier for each customer. It also creates a virtual account. When money is deposited into the CIPC bank account, the CUSTOMER CODE ONLY must be used as a reference to ensure that the money is allocated to the correct customer code.

Challenges are for example customers providing an O instead of Zero or vice versa, or i instead of I.

How do I get a CIPC Customer code?

Visit the CIPC website www.cipc.co.za and click on the Register menu button on the top right corner, and select e-services. Select customer registration on the left menu and complete the required fields.

It is important to provide the correct email address and cell phone number, as these contact details are used for correspondence with customers.

I forgot my customer code, how can I determine what it is?

To determine your customer code please visit our e-services (https://e-services.cipc.co.za and click on Customer registration on the left menu. Enter your ID number and your surname and click ‘Continue.’ Your code will be displayed on the screen.

How do I update a customer code belonging to a company?

- Certified ID Copy of new Company Secretary/client dealing with CIPC on behalf of company (Certification not older than three months)

• Certified ID Copy or Resignation Letter of Previous Company Secretary

• Affidavit by CEO/Director/Manager of company confirming resignation of previous customer code holder, indicating that customer code belongs to company , and not to individual

• Certified ID copy (Certification not older than three months) of CEO/Director/Manager who signed the affidavit and;

- Customer code update form, CLICK HERE

Send all required documents via email to resetpassword@cipc.co.za

Important: The request for an update must come from the new email address which will be linked to your customer code.

I want to de-active or cancel my customer code – how do I do that?

The customer code /password reset team must be informed.

Complete the Customer contact details update form and indicate clearly that you would like to de-active your account. Attach a certified ID copy and send both documents to resetpassword@cipc.co.za

Is a customer code linked to a company or to a company registration number?

What happens a lot is that intermediaries register companies and say for example about 20 enterprises will display when they log in. However, the customer code is not linked to any enterprise.

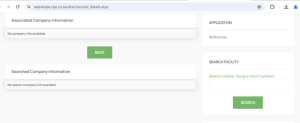

Any customer can visit the CIPC websites and sign in with their customer code and transact, for example if they want to file the annual return for their company, they visit the website and type in the enterprise. The same for director amendments. There will be a search facility available on the right menu, where you can type the relevant Enterprise number.

If the passport has expired, do I create a new customer code?

No, you need to send an email to resetpassword@cipc.co.za, together with the customer code update form and new passport and request the password reset team to update the passport number.

Can passport holders log on to Bizportal?

Yes, a passport holder can log on to Bizportal. When logging in, there will be a question: are you a South African citizen and they need to click no – then the passport holder tab will display.

However, a passport holder cannot register as a customer using Bizportal. They must first register as a customer using E-services

Can all the company employees use one customer code?

No, each customer must register their own customer code, as the model is one customer code per one ID number and person.

The customer cannot log in and see the status (F/Q/Suspended/etc.)

If a customer is unable to log in, they need to send an email to resetpassword@cipc.co.za together with a certified ID copy.

CIPC does suspend customer codes sometimes due to suspected fraudulent activities.

Can I transfer my customer code to my husband/friend/etc.?

No, each customer must register their own customer code.

Can we use the deceased customer code because we were sharing the same company or just to view the company’s records?

No. If a customer is deceased, the customer code needs to be de-activated.

If there is money in the customer code, the following documents must be sent to revenue@cipc.co.za:

- Death certificate of the deceased customer code owner

- Executor’s letter, indicating the ID number and detail of deceased and who is the executor of the Estate

- Proof of payment for all the money in the customer code

- Bank letter of Executor of Estate

Once the money has been paid to the Executor, a request must be send to resetpassword@cipc.co.za, together with the Customer code Update form and Death certificate to request the customer code to be made dormant.

Can the code be inherited?

No, a new customer code must be registered

Would a minor be allowed to register as a CIPC customer?

No, a minor cannot be registered as a CIPC customer.

Can I have more than one customer code?

No, each customer can only have one customer code.

How do I update my contact details on my customer code?

If your cell phone number is outdated, sign in to www.bizportal.gov.za with your ID, select reset password and click on User Profile to update the details. Kindly use the OTP that has been sent to your email address. After updating your contact details on bizportal, you can go to eservices to transact.

How do you reset a password?

If your cell number OR email address is up to date (or both), visit www.bizportal.gov.za and click on Login/Reset password. An OTP will be sent to the email address and cell phone number linked to your customer code. Type in the OTP and reset the password

What happens if a customer wants to reset their password, but both their cell number and email address are outdated?

The customer must do a “Manual” password reset by completing Customer code update form, available on our website under Resources / reset password.

Send the completed form, together with a certified ID copy of the owner of the customer code to resetpassword@cipc.co.za

The password reset team will update the email address and inform the customer of the update. If the customer wants the team to update the cell phone number as well, they need to submit proof of ownership of that cell number (i.e., a cell phone contract or any invoice).

How do I do a password reset as a passport holder? (the system does not allow more than 10-digit number)?

You can register as a customer using a passport by visiting https://e-services.cipc.co.za and click on Customer registration on the left menu. Indicate that you are not a SA citizen and provide your passport number. Complete the required fields.

Note: The telephone number only allows for 10 digits. Therefore, you need a South African telephone number to be able to register as a customer.

What is Beneficial Ownership?

In respect of a company, means an individual (warm body) who, directly or indirectly, ultimately owns that company or exercises effective control of that company.

Who is a Beneficial Owner?

An individual/ natural person who, directly or indirectly, ultimately owns 5% and more of a company or exercises effective control of a company.

Can a company/Trust be a Beneficial Owner?

No, only a natural person can be considered a beneficial owner

Who can file into a Beneficial Ownership Register?

Any person designated/mandated in writing by a company to file BO information on its behalf.

Does a filer need to present a Mandate in order to file the BO information?

Yes, without a valid mandate a filer is not permitted to transact on the BO Register. Filers are required to have a valid CIPC customer code in order to login to the CIPC e-services platform and file BO-information.

Is there a limit on the number of Beneficial Owners I can add into the Register?

No, there is no limit, as there could be more than one person considered a BO in a company

What is the minimum Threshold before a person can be considered a Beneficial Owner?

5% (five percent) – shareholding, beneficial interest, voting rights, etc.

If the details of the BO changes, can the BO filing be done any time?

Yes, whenever there are changes on the BO, a company has 10 (ten) days to update its BO/securities register – Regulation 32(3A) (non-affected companies) AND Regulation 32A (affected companies).

What is an affected company?

It is a regulated company as set out in section 117(1)(i) and a private company that is controlled by or a subsidiary of a

regulated company as a result of any circumstances contemplated in section 2(2)(a) or 3(1)(a).

• An affected company includes-

• A public company;

• A state-owned company;

• A private company – in terms of the transfer of securities when exceeding the percentage prescribed by Minister (10%)

within a 24-month period;

• A private company that is controlled by an affected company (regulated company) or is a subsidiary of an affected

company.

As a listed company, do I also file BO information with CIPC?

A listed company is considered an “affected company”, however, an affected company must file its beneficial interest register and/or securities register as prescribed in the regulations.

As a listed company, do my subsidiaries file BO Information with CIPC?

A subsidiary of a listed company is also considered an “affected company”, it has to file its securities register as prescribed in the regulations.

As a listed company, do I file my securities register with CIPC?

A listed company is considered an “affected company”, required to file its beneficial interest register as prescribed in the Regulations.

State Owned Companies, mostly have a Minister as a shareholder, who do I list as a Beneficial Owner?

The Minister in the event of 100% shareholding. However, in circumstances where an SOC has other shareholders and possible beneficial owners, the information must be declared.

Does the filing of the BO information replace the filing of the CoR39 (change of directors)?

No, CoR39 deals with directors, tasked with the day to day business and affairs of the company, whilst BO deals with unknown owners who ultimately owns a legal entity or exercises effective control of an entity.

How long do I have to file changes to the BO Register after changes take place?

10 business days.

From 01 April 2023, how long do we have for all entities to file BO Information?

Entities incorporated before 24 May 2023, must file the required information within 30 days from its anniversary date (FYE). Entities incorporated after 24 May 2023, must file their BO-information within 10 (ten) days of incorporation, as applicable.

What supporting information will be expected to be filed when filing for BO?